How to get blue dollar rate in Argentina? Blue dollar rate explained

When traveling to Argentina, the most important travel tip you should learn about is the “Blue Dollar”! If you want to get the most out of your money while visiting, knowing how to take advantage of this informal exchange rate can help you lower the costs of your trip by 50% (no kidding, I did that).

In short, you can get the blue dollar rate by exchanging cash in hotels or markets. Let’s break down what the Blue Dollar is, why it exists, how you can access it, and the safest ways to do so while traveling through Argentina.

Disclaimer: This page may contain affiliate links. If you use these links to buy or book something I may earn pennies at no additional cost to you!

What is the Blue Dollar?

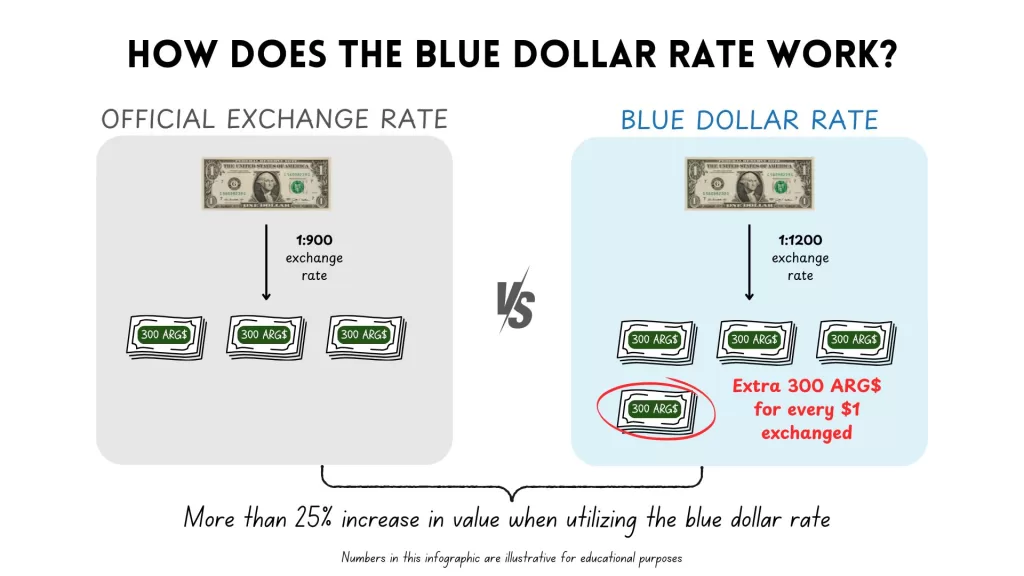

The Blue Dollar (Dólar Blue) refers to the unofficial exchange rate for U.S. dollars in Argentina’s informal market. While the official government exchange rate exists, it’s typically far less favorable than the rate you can get by exchanging your dollars through informal channels. In a country facing severe inflation and economic instability, the gap between the official and Blue Dollar rates can be quite large—sometimes as much as double.

How to Get the Blue Dollar Rate?

There are several ways you can take advantage of the Blue Dollar rate, but it’s important to be aware of both the risks and best practices to do so safely.

1. Bring U.S. Dollars in Cash

The simplest and most reliable way to get the Blue Dollar rate is to bring U.S. dollars in cash and exchange them once you arrive in Argentina. You can trade them for pesos at a far more favorable rate than what you’d get at official exchange houses or banks.

Where to exchange your dollars:

- Trusted hotels or shops: Some hotels and businesses will offer to exchange U.S. dollars for pesos at Blue Dollar rates. This method is safer but may not always offer the absolute best rate, but it is easy and safe. During my travels, I had no trouble exchanging my US dollars in supermarkets!

- Calle Florida, Buenos Aires: This busy pedestrian street is known for its money changers or arbolitos. While you can get the best rates here, it’s also a prime area for scams, so it’s crucial to be cautious.

Important: Make sure that the USD bills you bring are in mint condition. Any bills with minor stains or rips will not be exchanged. Argentinians also prefer newer bills, and I had bills from before 2012 that were rejected. A core memory from my time in Argentina was the supermarket cashier spending ~10 minutes inspecting my $1 bill before rejecting it due to a minor stain!

2. Use Western Union or MoneyGram Transfers

Western Union (and MoneyGram, to a lesser extent) has become a popular option for getting the Blue Dollar rate in a more secure way. You can send money to yourself or to a local contact while still in your home country. Once you arrive, pick up the cash in pesos at a Western Union location.

The great advantage here is that you’ll often get the Blue Dollar rate without the need to carry large amounts of cash on you. This is also a safer option for first-time visitors or those who don’t feel comfortable dealing with black-market currency exchanges.

To maximize this, send a large amount in one transaction, as each transfer incurs a small fee. To avoid carrying large sums of cash, withdraw the transfer in smaller values throughout the trip.

The rate you’ll get from Western Union is usually very close to the Blue Dollar rate, and you can easily find branches all over major cities like Buenos Aires and Córdoba.

3. Avoid Using Credit and Debit Cards

If you use your international credit or debit card for purchases or ATM withdrawals, you’ll be subject to the official exchange rate, which as we saw, is far worse than the Blue Dollar rate! As tempting as it may be to rely on the convenience of cards, you’ll lose a lot of value. In recent years, Argentina has introduced a tourist dollar (dólar turista), which allows foreigners to use their credit cards at a slightly better rate than the official one—but it’s still usually worse than the Blue Dollar.

Why Does the Blue Dollar Exist?

Argentina’s Blue Dollar market stems from strict currency controls imposed by the government, which limits how much foreign currency locals can legally obtain. With the peso losing value rapidly due to hyperinflation, Argentinians often turn to the black market to buy U.S. dollars as a way to protect their savings. Similarly, travelers can tap into this market to get better value for their currency, sometimes even doubling their purchasing power.

Is the blue dollar rate legal?

Exchanging money at the Blue Dollar rate in Argentina exists in a gray area. Technically, the Blue Dollar market is unofficial and operates outside government-regulated financial institutions, making it part of the “black market.” While it’s not illegal for tourists to participate in this market, Argentina’s government discourages it.

That said, exchanging dollars for pesos at the Blue Dollar rate is common among both locals and tourists, and enforcement against individuals is rare. Many travelers use options like Western Union, which offers near-Blue Dollar rates legally, providing a safer alternative without breaking any rules. As always, it’s wise to exercise caution and avoid sketchy situations when exchanging money.

Safety Tips for Exchanging Currency

Navigating the Blue Dollar market doesn’t have to be risky, but there are precautions to take to ensure a smooth experience:

- Avoid flashing large amounts of cash in public. Keep transactions discreet, especially on the streets.

- Check the current Blue Dollar rate. Before exchanging, make sure to check online resources like bluedollar.net to know the day’s rate.

- Don’t exchange too much at once. You may not need as many pesos as you think. Exchange smaller amounts frequently to avoid having excess cash when you leave the country. Argentinian peso leftovers are not like euros or USD, they decrease in value by the day. The leftover cash from my latest Argentina trip already decreased in value by almost 80%…

Exploring Argentina!

Taking advantage of Argentina’s unofficial exchange rate is one of the best ways to maximize your travel budget in the country. By exchanging U.S. dollars through safe channels like Western Union or trusted money exchangers, you can significantly increase your purchasing power, allowing you to enjoy more of Argentina’s incredible sights and experiences without breaking the bank.

Check out our guide on Iguazu Falls in Argentina to learn more about making the most of your time and money while traveling this amazing country!